When we choose a country to move to, we want to be sure that it will be safe and secure. That is why we will talk about the social security policy in New Zealand, as we never know how our life can change at any moment.

The State of New Zealand helps those who:

- Lost their job or are unable to work for some reason;

- Faced with urgent or unplanned expenses (this includes dentistry and ophthalmology, the breakdown of large equipment, home repairs, funerals, and so on);

- Need help with paying rent, school, utilities and other vital services;

- Retired;

- Faced relationship problems (broke up with their partners, lost a full-fledged family, lost a loved one or were victims of violence);

- Have encountered illness or disability;

- Have dependants;

- Have children;

- Were in an emergency due to weather events and cataclysms;

- Found themselves in a difficult situation as a teenager (16-19 years old).

Benefits for the unemployed

The amount of the benefit, its approval, and payment depend on each person’s individual situation.

Factors that influence the decision:

- Type of residence (with parents / partner / alone);

- The presence of children;

- Age;

- Health status;

- Availability of property/savings;

- Individual circumstances.

Also, to receive help, you must often have a place of residence (so you can still see homeless people on the country’s streets).

Benefits are paid every week. You will still pay taxes (the amount credited to the account will be already taxed).

The smallest amount is paid to single unemployed people aged 18-19 and still living with their parents – NZ$ 200.91 per week after taxes.

If you are 25 years old or more, without a family, and for whatever reason, you are unable to work, you will be paid NZ$ 278.50 per week after taxes. Unemployed couples get paid NZ$ 453.62.

These amounts may include additional payments you will receive to cover the rent/mortgage. The accommodation supplement amount depends on the place of residence and ranges from NZ$ 70 to NZ$ 165. A detailed calculation of payments can be found here.

If you are receiving unemployment benefits, you must try to find a job or solve your health issues.

To get a sense of how small (or large) the benefits are, we recommend reading the article on the cost of living in New Zealand.

Maternity payments and benefits for children

Maternity benefits in New Zealand are available if the woman has worked for the same employer for 6 or 12 months at least 40 hours per month before the due date of the child’s birth. The maximum period for receiving benefits is 26 weeks. Payments usually start after the baby is born.

The minimum maternity benefit is NZ $189 per week; the maximum is NZ $606.46 per week before taxes. They are usually paid once a fortnight. The amount of payments will depend on the size of your salary.

Benefits are only available to New Zealand citizens and residents who have resided in New Zealand for a year and tax residents. There are two programmes here: Best Start and Working for Families.

Best Start programme

It is available to everyone. Benefits are NZ $60 per week for the child’s first year. Best Start can be extended for the second and third years of a child’s life if the family income is less than NZ$ 93,858 per year. Best Start payments cannot be received simultaneously with maternity payments. Once your maternity benefits run out, you start getting Best Start.

From April 1, 2022, the size of Best Start payments will be increased to NZ $65 per week.

Working for Families programme

It is a programme for families earning NZ$ 27,768 per year or less after taxes. This also includes support for single parents. Single parents must work at least 20 hours per week, and full families must work 30 hours per week to be eligible for these benefits. This benefit increases household income by NZ$ 534 per week after taxes.

Starting April 1, 2022, Working for Families will receive an additional NZ$ 15 per week for the oldest child and NZ$ 13 for each subsequent child.

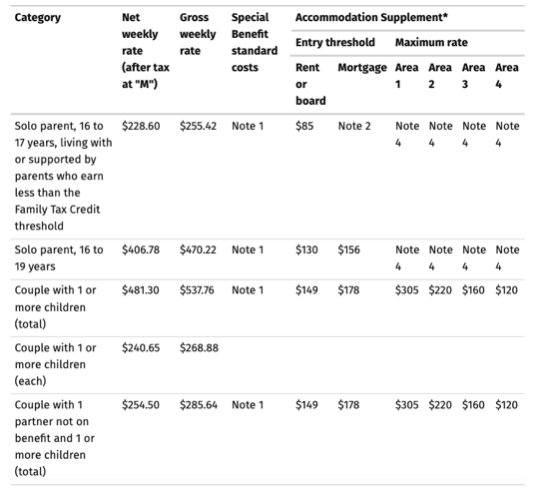

If you are a young parent (16-19 years old), you can count on other payments since the state provides additional support to teenage parents.

Pension payments

New Zealand has a New Zealand Superannuation (NZ Super) programme for retirees. If you are a 65 years old resident, permanent resident or citizen of New Zealand and have lived in the country for at least ten years, you can join the programme.

According to this programme, if you are single and live alone, your weekly pension is NZ$ 436.94 and NZ$ 403.33 if you live with someone.

If you have a partner and both of you are part of the NZ Super, together, you will get NZ$ 672.22. If only one of you qualifies for the programme, but you include your partner in the application, you will receive NZ$ 638.94. If not, then you will get NZ$ 336.11.

You will receive these payments every week, which is indicated after taxes. It may decrease if you have additional income or work.

In addition to your pension, you will get a SuperGold Card. This card provides you with discounts on various services, shops, restaurants, and cafes and allows you to use buses and parking for free, depending on your residence/stay region.

The government can also help pay for a retirement home if you consider moving there.

Community Service Card

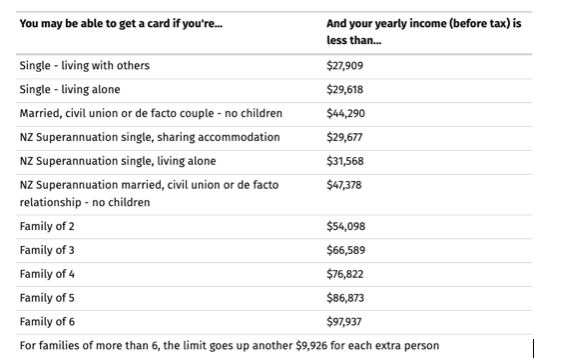

If you are employed but still face financial difficulties because your income is below average, you can get a Community Service Card. This card allows you to reduce healthcare costs: visits to the doctor and medications will cost less. You can also get a significant discount on dentistry and other medical services (for example, contraception). Some swimming pools also offer discounts for such cardholders.

To receive this card, you must be a citizen or resident of the country or a partner of a citizen or resident and have a below-average income.

KiwiSaver

Once you become a resident, you can open KiwiSaver. It is a programme that allows you to save money for your first home or retirement. You can donate 3%, 4%, 6%, 8% or 10% of your salary to the fund. Your employer will also deduct at least 3% on top of your contributions (this is not deducted from your salary).

If from July 1 to June 30 each year you have deposited at least NZ$ 1042.86 into KiwiSaver, the state will add NZ$ 521.43 to your fund. It means that the employer and the state contribute to your fund in addition to your contributions.

Then, your deposited money is invested in the fund of your choice, and it is constantly growing. You can choose aggressive investments, and your KiwiSaver will grow quickly, but it can also suffer large losses. Or conservative investments to insulate your savings from the effects of inflation.

Three years after opening KiwiSaver, you can use the accumulated money to buy your first home if you want. In general, people save this money for their old age.

You do not have the right to withdraw money from KiwiSaver. You will have access to money only after retirement or buying your first home. The only exception when you can withdraw money from KiwiSaver is if you find yourself in a very difficult situation. Even then, you will not be able to withdraw the entire amount.

Despite its already quite extensive social support, New Zealand is constantly working to make the lives of those in need better. Therefore, the amount of benefits and their list are regularly reviewed.

You can find a complete list of benefits and their size at this link.

If you are not a citizen or resident of the country, you can get assistance from non-governmental organisations, foundations and volunteer organisations operating in New Zealand. They can sometimes help with groceries and, in general, provide support to foreigners in difficult situations.